How to Avoid The True Cost of a Manual Advisor Transition

Why Advisor Transitions Are a Make-or-Break Moment

When a financial advisor changes firms, it’s more than just a move—it’s a high-stakes, high-pressure process. Broker-dealers and RIAs are often caught off guard by how complex, time-consuming, and error-prone financial advisor transitions can be. From paperwork delays to compliance breakdowns, the manual advisor transition process carries real risks.

Whether you’re a firm managing incoming advisors or an advisor making the leap yourself, it’s critical to understand the true cost of a manual transition—and how the right technology can eliminate those risks.

What Makes Transitions So Challenging?

The advisor transition process involves far more than account repapering. It requires:

-

- Transferring thousands of pages of client documentation

- Ensuring compliance with regulatory bodies like FINRA and the SEC

- Managing timing and approvals across multiple stakeholders

- Keeping advisors productive (and clients informed) through the chaos

- Coordinating custodial changes, form updates, CRM syncs, and rep codes

When these steps are handled manually—through spreadsheets, email threads, and disconnected PDFs—errors are inevitable.

The Real Cost of Manual Advisor Transitions

Manual processes might seem “good enough” if you’ve survived transitions in the past. But the operational toll can be steep:

-

- Lost Revenue Opportunities

Every day lost to administrative delays is a day of missed revenue. Advisors transitioning with slow or incomplete paperwork can’t serve clients or open accounts—costing firms thousands, or more, in opportunity costs. - Compliance and Regulatory Risk

The more manual your workflow, the greater your risk. Incorrect rep codes, missed disclosures, and outdated forms can all lead to audit issues or even regulatory penalties—especially if forms are completed inconsistently across clients. - Advisor Frustration and Attrition

Advisors expect support during a move. A clunky transition process sends the message that your firm isn’t prepared to empower them. This frustration can lead to early turnover or reputational damage that affects your recruiting pipeline. - Back-Office Burnout

Operations teams often bear the brunt of manual transitions. Hours of follow-up, form-filling, and document chasing add up quickly. This not only strains staff but reduces capacity to support other mission-critical functions.

- Lost Revenue Opportunities

Introducing: Forms Logic's Migrator Platform

To eliminate the complexity of advisor transitions, leading firms are adopting transition platforms like Forms Logic’s Migrator.

Migrator is a purpose-built financial advisor software solution. The design specifically supports RIA and broker-dealer transitions and onboarding. It automates the most tedious parts of the process—so advisors can hit the ground running, and firms can protect their time and reputation.

How Migrator Solves the Transition Problem

Here’s what you get with Forms Logic's Migrator:

-

- Preloaded Firm Paperwork: All firm-specific and custodial forms are available digitally—customized, updated, and ready to go.

- Bulk Data Entry: Enter data once and push it to hundreds of forms, eliminating rework and reducing human error.

- Automated Form Logic: Forms autofill with key client and advisor details, skipping irrelevant fields and flagging missing information.

- Real-Time Progress Tracking: Firms can monitor transition status across advisors, teams, or entire branches, in real time.

- E-Signature Integration: Secure, compliant signatures from clients and advisors—no printing, no scanning, no delays.

The result? A faster, more reliable advisor onboarding experience—with fewer errors, less stress, and better outcomes for everyone involved.

Where Navigator Comes In

Migrator takes care of the transition. After that, Navigator—Forms Logic’s digital workflow and forms automation platform—picks up where it left off. Once an advisor has moved, Navigator ensures their ongoing operations run smoothly:

-

- Client onboarding is digitized and consistent

- Forms stay compliant across product lines

- CRM data is validated and reused

- NIGO errors are drastically reduced

For firms managing growth, having both platforms in place means they’re prepared for everything—from new advisor recruitment to long-term scalability.

Don’t Let Transitions Derail Growth

It’s easy to underestimate the true cost of manual advisor transitions—until you’ve experienced one that went off the rails. Lost time, regulatory risk, and frustrated advisors can set your firm back months.

The solution isn’t more manpower—it’s workflow automation built for financial advisors. With Migrator, you can transition advisors confidently, professionally, and at scale. Pair it with Navigator to ensure a seamless post-transition experience.

Ready to reduce risk and reclaim your time during advisor transitions?

Schedule a demo — Let us show you how Migrator helps firms and advisors move forward.

Top Compliance Challenges in Account Transitions – And How to Solve Them

Introduction

Advisor transitions are complicated — but they’re also a powerful opportunity. Transitions are one of the best ways to grow AUM, expand client relationships, and attract top talent. Unfortunately, they also contain compliance risk. Every step — from re-papering accounts to suitability checks — must align with FINRA, SEC, and internal firm policies.

Missing a step doesn't just create administrative headaches — it can lead to regulatory exposure and reputational damage.

That’s why the most successful broker-dealers and RIAs are rethinking their approach to transitions. The right technology can reduce risk, speed up onboarding, and keep your firm audit-ready throughout the entire process.

What Makes Transitions So Risky?

Transitions compress dozens of client actions into a high-pressure window. Multiple forms must be re-collected. Signatures must be tracked. Suitability must be reverified — all while the back office juggles submissions, validates information, and meets deadlines.

Manual transitions — often reliant on PDFs, email chains, and handwritten notes — are a minefield. A single missed checkbox or outdated form can create a NIGO submission and delay the entire process.

Top Compliance Pitfalls to Watch For

✅ Not-In-Good-Order Paperwork

Missing fields, outdated disclosures, or mismatched client data points lead to NIGOs — the #1 source of delays and rework. Every piece of NIGO paperwork increases the risk of audit scrutiny and client frustration.

✅ Disconnected Systems

A lack of integration between CRMs, forms, and e-signature tools increases the chance of human error. This disconnection necessitates data re-entry and can lead to inconsistent records. It opens the door for audit gaps and additional errors.

✅ Inconsistent Approvals

If your workflows don't enforce signature order or supervisory review, your firm may be unable to prove suitability or compliance in the event of an audit.

✅ Weak Audit Trails

Manual processes lack reliable records. Without time-stamped activity logs, your firm may struggle to defend its actions during a regulatory exam.

Solving Advisor Transition Compliance Headaches

The key to avoiding these traps is to bring automation and validation into every stage of the transition. This helps avoid errors in every step from data migration and client or financial advisor onboarding to daily processing.

This is where Forms Logic’s dual-platform approach comes in.

Migrator for Transitions

Forms Logic built its Migrator platform specifically for advisor transitions. It ensures that when a new advisor starts at your firm, you complete everything correctly and quickly from day one. Key features include:

- Automated Re-Papering: Migrator dynamically generates forms based on the advisor’s book of business. That includes pre-configuring required disclosures and client types.

- Transition Audit Tracking: Every form submission, signature, and approval is time-stamped and accessible for review.

- Advisor Visibility: Advisors can track where every client household is in the process — reducing unnecessary calls and stress.

Migrator’s primary role is to get the advisor up and running while ensuring regulatory readiness from the outset. But compliance doesn’t stop there — which is where Navigator comes in.

Navigator for Ongoing Compliance

Forms Logic's Navigator platform is the workflow engine. It ensures accuracy, automation, and oversight for all client-facing forms throughout and after a transition. It works alongside Migrator or as a standalone solution for ongoing operations.

Here’s how it supports long-term compliance:

✅ Smart Forms and Validation

Navigator makes sure that users create forms correctly. It fills the forms with checked CRM data and reviews them for NIGO risks before sending them out.

✅ Integrated E-Signature

Clients sign digitally, with every action tracked and logged — including timestamps, IP addresses, and review chains.

✅ Automated Workflow Routing

Forms are routed through proper approval paths automatically, ensuring nothing gets skipped or lost.

✅ Centralized Audit Trails

Navigator stores every action in a searchable, audit-ready log. This simplifies regulatory reviews and supports internal accountability.

Combining Digital Tools

Together, Migrator and Navigator create a continuous thread of compliance support:

Migrator gets the advisor onboarded with correct forms, workflows, and transition tracking.

Navigator continues supporting that advisor with automated daily workflows, reducing NIGOs, and maintaining audit-readiness.

This ensures your firm doesn’t just meet regulatory requirements — it builds a reputation for smooth, secure transitions and efficient operations.

A Real-World Example

Imagine onboarding a new advisor with 250 client households. Without technology, each household might require multiple forms, wet signatures, and repeated manual reviews. One missed signature could delay dozens of accounts.

With Migrator, Forms Logic can digitize, re-paper, and track the advisors entire book of business with full visibility. Once live, Navigator ensures every new form is accurate, pre-validated, and tracked — avoiding NIGOs and compliance headaches.

The result? You — and your clients — experience fewer delays, less rework, and total confidence that every regulatory box is checked.

Final Thoughts

Ensuring compliance can’t be an afterthought — especially during advisor transitions. But it also doesn’t have to be a burden. With the right digital platforms, your firm can:

- Eliminate transition inefficiencies

- Reduce NIGO errors

- Simplify audits

- Support advisors and back-office teams

- Protect client trust

Migrator ensures your transition starts right.

Navigator ensures it stays that way.

Want to see how both platforms work together? Schedule a demo or contact us today

From Paper to Platform: The Evolution of Forms Management in Financial Services

Introduction

Forms are the backbone of every financial firm’s operations — yet they’ve also been one of the biggest roadblocks to efficiency for decades. From new account openings to advisor transitions, paper-based forms create errors, delays, and wasted hours for advisors, clients, and back-office staff alike.

The good news? The industry has come a long way. Forward-thinking broker-dealers and RIAs now recognize that digital forms platforms don’t just speed up paperwork — they protect compliance, improve client experience, and help firms grow with fewer costly errors.

A Look Back: The Paperwork Problem

Not long ago, every account change, transfer, or onboarding required printing out stacks of paper. Advisors would manually enter client data multiple times — once on an application, again on a custodial form, again in the CRM — creating endless opportunities for mistakes.

Paper forms get lost. Signatures get missed. And when a regulator comes knocking, back offices scramble to find physical files that may or may not be stored correctly. For firms managing dozens of transitions each year, this was an operational nightmare that also put compliance at risk.

How Digital Forms Changed the Game

The first wave of improvement came with simple PDFs. But those still required manual data entry and printing — better than pure paper, but far from perfect. The real shift happened when wealth management firms began investing in true digital workflow platforms like Navigator.

These solutions don’t just store forms online — they connect them to the rest of your systems. When a client’s address changes, the CRM updates, and that data auto-populates on every relevant form. Validation rules flag errors before submission, reducing Not In Good Order (NIGO) paperwork.

E-signature integrations make it easy for clients to sign from anywhere. Advisors no longer chase wet signatures or overnight packages — they get notified when forms are complete, so they can move on to serving clients.

Key Benefits of Modern Forms Management

- Fewer Errors, Faster Processes

When advisors don’t have to enter data multiple times, the chance of mistakes drops dramatically. Smart validation catches missing fields and mismatched info before it ever leaves the platform. - Better Client Experience

Today’s investors expect digital ease — not a stack of paper forms to sign by hand. A smooth, digital workflow signals that your firm is modern, organized, and respectful of their time. - Stronger Compliance Oversight

Digital platforms create a secure, time-stamped record of every action. When regulators want to see how an account was opened, you have a clear audit trail ready to go. - Scalability for Growth

As firms recruit more advisors or open more accounts, manual paperwork becomes impossible to manage. A digital workflow platform scales with your business, so you’re not hiring extra staff just to handle forms.

From Transition Packages to Everyday Maintenance

Forms management isn’t just about onboarding new clients — it impacts every part of an advisor’s day. When an advisor moves to your firm, a poor form process can drag out a transition for weeks or months. Clients get frustrated when they have to sign the same details multiple times. Advisors get burned out chasing signatures and fixing NIGO errors.

But with a connected platform, the same data flows across multiple forms. A new client’s details entered once can be reused for account transfers, beneficiary updates, or regulatory disclosures — no duplicate entry, no surprises.

How Forms Logic’s Navigator Platform Helps

Navigator takes digital forms management to the next level for broker-dealers and RIAs. It connects with your CRM, automates workflows, validates data in real time, and supports flexible e-signature options. This means fewer errors, faster processing, and an audit-ready record for every step.

Many firms find that once they implement Navigator, they see dramatic drops in NIGO rates, faster transitions for new advisors, and less rework for back-office teams. That means more time for growth-focused tasks and a better experience for everyone involved.

A Real-World Scenario

Imagine a mid-sized RIA onboarding a new advisor with 100 households. In a paper-based system, each account requires fresh forms — often with redundant information — plus manual checks for accuracy.

With a modern platform, the advisor’s client data flows from your CRM. Forms are bundled automatically with the right disclosures. Smart checks flag errors instantly. E-signature lets clients sign at their convenience, and your team tracks every step on one dashboard.

The result? Faster onboarding, fewer mistakes, and stronger relationships with both advisors and clients.

Final Thoughts

Forms may not be the most glamorous part of wealth management — but they’re where trust and efficiency live or die. Moving from paper to a connected digital platform helps all types of wealth management firms (broker-dealers and RIAs, in particular) protect compliance, reduce headaches, and prove to advisors that you’re a firm ready for the future.

When your forms are in good order, everything else can run smoothly. The evolution is clear: it’s time to trade the filing cabinets for a single, smart source of truth.

The Best CRM for Financial Advisors: Choosing the Right Fit for Your Workflow

Why CRM Software Is Essential for Financial Advisors Today

In the financial services industry, efficiency isn’t optional — it’s a competitive requirement. Your CRM platform choice determines how well you can serve clients, manage risk, and scale operations. This holds true whether you're a solo investment advisor, a growing RIA, or part of a larger broker-dealer.

A CRM solution (Customer Relationship Management) is the backbone of any modern financial practice. It organizes and centralizes client information, tracks engagement, supports compliance, and increasingly, integrates with platforms that drive automated workflows. These platforms could include e-signature tools, account opening systems, and digital onboarding platforms.

Yet with so many CRM softwares for financial advisors on the market, how do you choose the right one?

Good news: you don’t have to choose just one perfect system. With tools like Forms Logic’s Navigator, you can integrate the best CRM for your needs and preferences. Navigator also helps automate manual tasks like document creation, back-office routing, and compliance checks.

Choosing the Best CRM for Financial Services: A Comparison

Let’s explore some of the top CRM solutions for financial advisors. Each offers unique benefits based on firm size, focus, and tech needs.

1. Redtail

Redtail is one of the most widely used financial advisor CRMs. Redtail tailors its services specifically to the needs of the wealth management industry.

- Why it works: Its clean interface and advisor-first design simplify contact management, document tracking, and workflow triggers. Redtail also offers native integrations with custodians, planning tools, and compliance platforms.

- Use Case: Perfect for small to midsize advisory teams seeking a cost-effective, easy-to-use solution.

Pros:

-

-

- Purpose-built for financial services

- Affordable pricing

- Strong integration ecosystem

-

Cons:

-

-

- Less flexible than enterprise tools

- Some interface limitations

-

2. Wealthbox

Wealthbox has emerged as a sleek and user-friendly wealth management CRM. Its intuitive design and collaborative features make it a favorite for modern advisor teams.

- Why it works: Real-time activity streams, email integration, and ready-made workflows help small teams work quickly. Wealthbox helps them avoid getting stuck in IT problems.

- Use Case: Ideal for solo advisors or small RIAs wanting quick setup and visual dashboards.

Pros:

-

-

- Beautiful UI and fast adoption

- Collaborative tools for teams

- Native integrations with leading tools

-

Cons:

-

-

- Less customizable

- Limited legacy system integration

-

3. Salesforce

Salesforce is the gold standard in enterprise CRM software — and its Financial Services Cloud adds wealth-specific features.

- Why it works: Firms can track complex household relationships, automate client onboarding, and generate custom reports at scale. But it requires IT support and training.

- Use Case: Mid-to-large RIAs or broker-dealers with internal IT teams.

Pros:

-

-

- Fully customizable

- Strong analytics and data modeling

- Enterprise-grade scalability

-

Cons:

-

-

- Expensive

- Requires configuration and ongoing maintenance

-

4. Advisor Engine (Formerly Junxure)

Junxure, now under AdvisorEngine, is a CRM solution with deep functionality for firms that prioritize compliance and document control.

- Why it works: It’s strong in practice management, offering detailed task tracking, document workflows, and compliance recordkeeping.

- Use Case: RIAs and broker-dealers with complex internal processes or compliance-heavy operations.

Pros:

-

-

- Compliance-focused

- Document workflow automation

- Built-in advisor task management

-

Cons:

-

-

- Dated user interface

- Integration limitations

-

5. Tamarac (WealthSuite)

Wealth management CRM systems like Tamarac appeal to tech-forward RIAs. Developers created Tamarac using Microsoft Dynamics and incorporated it into Envestnet's ecosystem.

- Why it works: The ability to unify portfolio management with CRM data makes Tamarac ideal for performance-focused firms.

- Use Case: RIAs already using Tamarac PortfolioCenter or other Envestnet services.

Pros:

-

-

- Seamless integration with Envestnet

- Built-in performance data tools

- High degree of customization

-

Cons:

-

-

- Pricey for small firms

- Higher learning curve

-

6. SmartOffice

SmartOffice is a CRM designed specifically for financial professionals, offering powerful integrations with insurance, investment, and planning tools.

- Why it works: SmartOffice focuses on streamlining client data, insurance policy tracking, and appointment workflows — all tailored to the unique needs of financial advisors and insurance agents.

- Use Case: Well-suited for firms with strong insurance operations, hybrid models, or advisors affiliated with insurance-focused broker-dealers.

Pros:

-

-

- Industry-specific functionality

- Strong insurance and annuity tracking

- Seamless integration with many carrier platforms

-

Cons:

-

-

- Interface may feel dated

- Not as customizable as enterprise CRMs

-

How CRM Integration Boosts Advisor Efficiency

Selecting the top CRM for financial advisors is only part of the equation. What significantly boosts productivity is how your CRM software connects with other systems. Connecting CRM software with digital onboarding and workflow automation platforms is the new golden standard.

Disconnected CRMs often result in:

- Re-entered or inconsistent customer data

- Missed compliance checkpoints

- Delays in onboarding and maintenance

- Unhappy advisors and clients

That’s why integration matters.

The Navigator Advantage: Make Your CRM Work Harder

Forms Logic’s Navigator platform is a workflow automation solution designed to reduce NIGO errors and eliminate operational inefficiencies — without requiring you to change your CRM.

With Navigator, your CRM becomes the starting point for every downstream process. Whether you're using Redtail, Salesforce, or Wealthbox, Navigator supports seamless integration to:

- Auto-populate forms using CRM data

- Reduce manual input errors

- Trigger onboarding workflows

- Facilitate e-signature capture

- Maintain audit-ready records

It works with virtually any CRM in the financial services industry, meaning your firm’s advisors can continue using the tools they love — while gaining consistency, speed, and compliance downstream.

Benefits of CRM + Workflow Automation

Navigator enhances any CRM by layering automation and standardization on top of it.

Here’s what that looks like:

- One-time client entry: Enter client data in your CRM once — Navigator maps it across all forms and paperwork.

- Rules-based workflows: Navigator automatically routes tasks based on line of business, advisor role, and required compliance steps.

- Real-time updates: Clients sign forms digitally and the system updates CRM records instantly.

- Clear visibility: Built-in dashboards show status at every step — reducing back-office follow-ups.

Final Thoughts: Choose the CRM That Works Best — We’ll Handle the Rest

A single “best CRM for financial advisors" doesn't exist. The right system depends on your firm’s size, budget, and workflow needs. But with Forms Logic, you don’t have to compromise.

Whether you’re using Redtail, Salesforce, Wealthbox, Tamarac, or any other leading CRM software for financial advisors, Navigator integrates seamlessly — transforming a standalone CRM tool into the hub of a fully automated, compliance-ready process.

Ready to turn your CRM into an efficiency engine?

Let Forms Logic help you streamline every step, from client onboarding to ongoing account management: Schedule a Demo

Workflow Automation for Advisors Transforms Onboarding

The Evolving Account Opening Process

In today’s fast-paced financial services landscape, firms face growing pressure to improve efficiency, deliver exceptional customer experiences, and maintain airtight compliance. The legacy account opening process—reliant on paper forms, manual data entry, and disparate systems—simply cannot keep pace. Errors mount, compliance teams scramble to fill gaps, and clients grow impatient.

Instead, the modern standard features digital onboarding solutions, workflow automation for advisors, and account opening automation. Together, these tools change how firms create new accounts. Advisors no longer need to chase signatures or deal with old portals. Instead, they leverage intelligent workflow platforms to streamline every step.

Why Account Opening Automation Is a Game-Changer

Account opening automation replaces manual tasks with configurable, rules-driven flows. Rather than shuffling paper among operations, compliance, and custodians, firms set up:

-

- Automated rules to route digital forms for signature and validation

- In-line compliance checks that flag missing disclosures before submission

- Real-time status dashboards to monitor each application’s progress

Centralizing these processes in a unified management system increases the efficiency and accuracy of all operations. Firms reduce back-and-forth, eliminate redundant data collection, and accelerate time-to-funding. Advisors spend less time on paperwork and more time delivering tailored advice—driving both satisfaction and revenue.

Forms Logic Navigator: The Heart of Seamless Onboarding

Forms Logic’s Navigator platform sits at the intersection of data, forms, and compliance. As a true client onboarding fintech solution, it combines:

-

- Centralized client data storage and governance

- Dynamic digital form generation tailored to each account type

- Embedded compliance checks, aligned with regulatory regimes

- Role-based access for advisors, operations, and compliance teams

- Full CRM integration to ensure a single source of truth

Navigator’s flexible workflows allow companies to create onboarding processes that smoothly integrate into their day-to-day business operations. Navigator provides the flexibility and control needed to tailor onboarding solutions, manage compliance requirements, and support scalable growth.

Deep Dive: How Digital Onboarding Solutions Improve Efficiency

The transformative power of digital onboarding solutions lies in optimizing every step of the journey:

-

- Data capture and verification: Advisors enter client data once via an intuitive portal. Advanced validation rules ensure that information is clean and complete from the outset.

- Automated document distribution: Approved forms automatically go to clients for e-signature. They also go to custodians for account setup and to internal teams for review. This orchestration eliminates manual hand-offs and prevents bottlenecks.

- Intelligent exception handling: When an exception arises—say, a missing tax ID—Navigator’s workflow automation flags the item. It then routes it to the appropriate team member and tracks resolution in real time.

- Audit-ready reporting: The system logs every action, timestamp, and approval in an immutable audit trail. Granular compliance checks make regulatory examinations smoother and reduce the risk of fines.

These capabilities, powered by workflow automation for advisors, translate into measurable benefits:

-

- Faster account openings

- Significant reduction in NIGO errors

- Increase in advisor capacity to serve clients

Ensuring Data Integrity with Centralized Data Collection

Accurate client data sits at the heart of compliant, efficient onboarding. Multiple entries of the same information across systems create mismatches that lead to delays—or worse, compliance violations. Navigator’s digital forms are directly tied to a centralized data collection engine, which:

-

- Prevents duplicate entries by syncing fields across all forms

- Maintains versioned records so historical data remains accessible

- Enforces mandatory fields and validation rules at data-entry points

With this structure, companies avoid the frustration of mixed-up information. It ensures that every stakeholder—advisors, custodians, and operations—uses the same data.

Best Practices for Deploying Workflow Automation

Successfully implementing workflow automation requires more than flipping a switch. Firms that achieve rapid ROI follow a structured approach:

-

- Map existing processes. Document current onboarding processes, identify pain points, and catalog exception scenarios.

- Define success metrics. Establish KPIs—such as average days to open, NIGO error rate, and advisor time saved—to measure improvements.

- Phase the rollout. Start with a high-impact account type (e.g., new retail brokerage accounts), then expand to more complex workflows.

- Train stakeholders. Ensure advisors, operations, and compliance teams understand new workflows, notification mechanisms, and exception-handling steps.

- Iterate continuously. Use built-in analytics to identify bottlenecks and refine workflows regularly.

By following these steps, firms maximize the benefits of account opening automation while minimizing disruption.

Conclusion: Bridging Efficiency and Compliance

The era of paper-hampered onboarding is over. By embracing workflow automation for advisors, account opening automation, and holistic digital solutions, firms can:

-

- Accelerate the account opening process

- Ensure data accuracy through centralized data collection

- Embed compliance checks into every workflow step

- Empower advisors to focus on client relationships rather than paperwork

Forms Logic Navigator is a complete financial services platform. It brings together client data, digital forms, and easy-to-read reports in one simple interface. Navigator helps you work better and have more control. It is useful for everyone from broker-dealers updating old systems to RIAs expanding their operations.

Ready to transform your onboarding processes?

Schedule a demo to see how Navigator can revolutionize your digital onboarding journey.

The Hidden Cost of NIGOs and How to Fix Them

The Hidden Cost of NIGOs and How to Fix Them

In the financial services industry, efficiency and accuracy aren’t just operational preferences—they’re essential for compliance, profitability, and client satisfaction. Yet, one silent saboteur continues to plague broker-dealers, registered investment advisors (RIAs), and financial advisors alike: NIGOs—or Not in Good Order business submissions (new business and maintenance).

If your firm is still struggling with frequent NIGOs, you’re not alone—but you are paying for it. In this post, we’ll explore the true cost of NIGOs, why they persist, and how digital solutions like Forms Logic’s Navigator platform can help you eliminate them for good.

What Are NIGOs?

A NIGO, or "Not in Good Order" document, refers to any form or piece of paperwork that is submitted with errors, omissions, or missing information that makes it unusable or non-compliant. These can include:

- Missing client signatures

- Incomplete fields

- Mismatched data across forms

- Outdated disclosures

- Illegible handwriting (yes, paper forms are still in use!)

Each time a form is rejected due to a NIGO error, the firm must re-engage the client, correct the issue, and reprocess the form—creating delays, operational friction, and reputational damage.

The True Cost of NIGOs

The impact of NIGOs goes well beyond minor inconveniences. Here's what they're really costing your firm:

-

Financial Loss:

Every NIGO costs time and money. Reprocessing forms, chasing down signatures, and resubmitting documents consumes advisor and staff time that could be better spent on revenue-generating activities.

Industry estimates suggest that firms can lose hundreds of dollars per NIGO, especially when it results in delayed account openings or missed investment opportunities. -

Delayed Onboarding and Revenue:

Each day a client’s paperwork sits in limbo due to a NIGO, your firm is potentially losing money. Whether it’s a new account or a product switch, NIGOs delay asset transfers, commission payments, and the advisor’s ability to serve the client.

-

Advisor Frustration and Attrition:

Nothing is more frustrating to a financial advisor than losing face with a client due to back-office errors. When NIGOs become habitual, they can erode advisor trust and loyalty—leading to higher attrition and more expensive recruiting cycles.

-

Compliance Risk:

NIGOs aren’t just an operational problem—they’re also a compliance red flag. Forms submitted with errors or incomplete disclosures can lead to audit issues, regulatory scrutiny, or worse: fines.

Why NIGOs Happen

If your firm is dealing with frequent NIGOs, it’s worth understanding where the problem originates. Common root causes include:

-

Manual Data Entry:

Re-entering the same client information across multiple systems or forms increases the chance of error.

-

Lack of Standardization:

Inconsistent forms and processes across product lines or custodians lead to confusion and mistakes.

-

Legacy Systems:

Paper-based workflows and fragmented technology stacks can't keep up with modern compliance and client expectations.

-

Insufficient Checks:

Without built-in logic, advisors can easily miss required fields or submit outdated documents.

How to Fix NIGOs

The best way to reduce and eventually eliminate NIGOs is by adopting a digital processing platform with built-in compliance logic and automation. Enter: Navigator from Forms Logic.

Navigator is a cloud-based, end-to-end workflow automation solution built specifically for broker-dealers and RIAs. Here's how it helps fix the NIGO problem:

-

Single Data Entry:

Advisor inputs client data once, and Navigator intelligently maps it across all required forms—whether it's brokerage, annuities, alternatives, or insurance.

-

Built-In Form Logic

The platform includes real-time form validation, ensuring required fields are completed before submission. Say goodbye to missing signatures or incomplete checkboxes.

-

E-Signature Integration

Navigator supports compliant e-signature platforms, so clients can sign documents quickly and securely, without printing or scanning.

-

Automated Workflows

With pre-defined steps for each line of business, Navigator ensures that nothing is skipped and everything is submitted in the right order, to the right party.

-

Audit-Ready Compliance

Every document processed through Navigator is stored securely with an audit trail—making compliance checks faster, easier, and more reliable.

Why Firms Choose Forms Logic

At Forms Logic, we’ve helped firms transition from paper-heavy processes to streamlined digital workflows—reducing NIGO rates by over 70 percent in many cases.

Whether you're onboarding new clients or helping advisors transition books of business, our solutions—Navigator and Migrator—offer:

- Fast implementation (90 days or less)

- End-to-end processing for all lines of business

- Custom workflows to match firm-specific compliance needs

- Real-time support and advisor visibility

With no implementation fees and a performance-based pricing model, we make it easy for firms of all sizes to eliminate NIGOs and embrace digital transformation.

Final Thoughts

NIGOs may seem like a small nuisance, but their cumulative effect can drag down your entire business—costing money, compliance credibility, and advisor trust.

But they don’t have to.

With the right platform in place, your firm can move from reactive error correction to proactive process automation. Navigator makes that possible—allowing your advisors to focus on what really matters: serving clients and growing the business.

Ready to eliminate NIGOs for good?

Schedule a demo to see how Forms Logic can help your firm digitize workflows, reduce errors, and drive efficiency from day one.

Thurston Springer’s Digital Transformation with Navigator

We’re proud to share that Thurston Springer Financial, a respected wealth management firm, recently featured Forms Logic in an AdvisorHub article, highlighting their use of our Navigator platform to modernize and streamline their advisor operations.

As a valued client, Thurston Springer recognized the importance of equipping their financial professionals with tools that cut through paperwork and improve efficiency. Their public recognition underscores how critical the right technology is for firms looking to stay competitive.

Why Navigator?

Navigator is a powerful automation and workflow platform built specifically for financial services. Designed to eliminate manual data entry and reduce compliance risk, Navigator offers:

- Automated Workflows: Reduce manual data entry and enhance accuracy.

- Seamless Integrations: Connect effortlessly with existing systems and data sources.

- Enhanced Compliance: Ensure adherence to industry regulations with built-in checks.

- Scalability: Adapt to the growing needs of financial firms without increasing overhead.

The Bigger Picture: A Shift Toward Efficiency

In a heavily regulated and document-driven industry, advisory firms are increasingly investing in tools that automate the back office—freeing up time for what matters most: building client relationships. The article on AdvisorHub underscores this trend and illustrates how firms like Thurston Springer are proactively adapting.

See the Full Story

To learn more about how Thurston Springer is using Navigator to advance their digital transformation goals, check out the article here:

AdvisorHub: Thurston Springer Launches Forms Logic to Accelerate Digital Transformation

Bridge6: Taking the Chaos Out of Advisor Transitions

Advisor transitions are high-stakes. Whether you’re an advisor moving your book or a firm welcoming new talent, there’s a lot on the line: client trust, regulatory compliance, and uninterrupted revenue. But many transitions are messy—slowed by inconsistent processes, scattered data, and hours of repetitive paperwork. That’s exactly what Bridge6, the transition framework from Forms Logic, was built to fix.

Bridge6 brings structure to what is often a disorganized process. Instead of starting from scratch with every move, advisors and firms follow a clear six-step path designed to reduce errors, accelerate onboarding, and keep clients at the center of the experience. It starts with planning and ends with execution—but in between, it’s all about gathering the right data, automating workflows, and delivering a smooth, compliant transition.

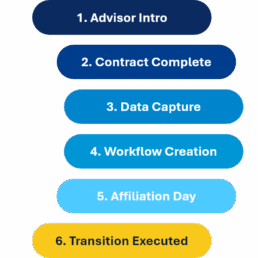

Here’s how the Bridge6 process works:

-

- Advisor Introduction – Plan the move and align on timelines, account types, and communication strategy. Leverage a detailed checklist to gather all information.

- Contract complete – Formalize the agreement and confirm data-sharing compliance.

- Data Capture – Gather, organize, and standardize client data from all sources.

- Workflow Creation – Build automated processes that generate a form bundle to prepare for pending client signature.

- Affiliation Day – Go live and begin the signing and onboarding process.

- Transition Executed – Complete account transitions and track every step through a live dashboard.

- Advisor Introduction – Plan the move and align on timelines, account types, and communication strategy. Leverage a detailed checklist to gather all information.

This method doesn’t just look good on paper—it delivers real results. As shared in our webinar and eBook, firms using Bridge6 through the Forms Logic platform have cut transition timelines by nearly half, potentially saving tens of thousands or more in revenue loss depending on your total AUM. More importantly, advisors feel supported instead of overwhelmed—and clients stay confident throughout the process.

Ready to Learn More?

Seamless Transitions: The Advisors Guide to Moving with Confidence

Onboarding Advisors without the Chaos

Migrator: The Best Advisor Transition Software for RIAs and Broker-Dealers

RIA and Broker-Dealer transitions can be complex and time-consuming. Forms Logic’s Migrator software streamlines the advisor transition process, automating compliance paperwork and reducing delays for financial professionals. Here’s why clients choose Migrator to streamline their transitions:

- Comprehensive Logic for All Firms, Vendors, and Custodians FL works to ensure there is a complete library of logically coded forms for every major firm, vendor, and custodian in the industry. This ensures you have the exact documentation needed for account openings and transitions without the hassle of manual research and form preparation.

- Proprietary Upload Spreadsheet for Data Normalization Our proprietary upload spreadsheet allows users to normalize all client account data. This step ensures a clean, organized data set that can be seamlessly loaded into the Migrator system. No more worrying about data inconsistencies or mismatched formats.

- Intelligent Form Selection and Auto-Population Once your data is uploaded, Migrator’s advanced logic determines the specific forms required for each account opening. It then auto-populates these forms with the relevant data from your spreadsheet, saving hours of manual input and reducing the potential for errors.

- Flexible Sign Options and Back-Office Integration Migrator offers both print and e-signature options for completed forms. Regardless of the signing method chosen, the system ensures that completed forms are routed directly to the back office for swift processing. This end-to-end workflow eliminates unnecessary delays and keeps your transition on track.

- Fast Implementation and Transition Timelines

- New Firm Setup: Migrator can onboard a new firm in just 2-4 weeks, depending on the quality of the forms provided.

- Transition Timelines: Once the site is set up, each advisor transition can be completed in as little as two weeks, with a typical estimate of four weeks depending on the availability and quality of data.

Why It Matters Migrator reduces the stress and complexity of advisor transitions by leveraging intelligent technology and streamlined workflows. With faster transitions, fewer errors, and comprehensive support, Migrator empowers firms to maintain business continuity while scaling their operations.

Ready to transform your transition process? Migrator is here to make it happen.

The Key to a Smooth Advisor Transition: Accurate Client Data

Transitioning to a new firm is a pivotal moment for any financial advisor. While many factors contribute to a successful transition, one element stands out as crucial—accurate client data. Without it, completing paperwork, onboarding clients, and ensuring a seamless transition become significantly more difficult. In this blog, we’ll explore why accurate client data is essential and how it impacts every step of the transition process.

The Role of Accurate Client Data in Transitions Every advisor transition involves paperwork, from account opening forms to transfer authorizations and compliance documentation. Having incomplete or inaccurate client data can lead to delays, errors, and frustrated clients (and you as the advisor!). Here’s why precise data is critical:

- Efficient Paperwork Completion

Most transitions require a substantial amount of documentation. Missing or outdated client details, such as incorrect Social Security numbers, outdated addresses, expired driver's licenses, or missing account numbers, can cause unnecessary delays and rework. - Faster Client Onboarding

Accurate data ensures a smoother onboarding experience, reducing back-and-forth communication with clients and custodians. Advisors who enter transitions with well-organized client records can expedite the process and avoid bottlenecks. - Regulatory and Compliance Accuracy

Compliance requirements demand precise documentation. Errors in client data could trigger compliance issues, requiring additional verification and delaying account transitions. - Enhanced Client Experience

Clients expect a seamless transition. When their accounts are moved efficiently without administrative headaches, it reinforces trust in the advisor’s ability to manage their wealth effectively.

How to Ensure Data Accuracy Before a Transition To mitigate potential challenges, advisors should take a proactive approach to data management before initiating a transition:

- Conduct a Data Audit – Review client records and verify key details such as contact information, account numbers, and beneficiary designations.

- Use CRM Systems Effectively – Ensure that all client information is up-to-date in your CRM and synced with custodians and back-office systems.

- Standardize Data Entry Practices – Implement consistent data entry protocols to prevent errors and inconsistencies.

- Leverage Technology for Validation – Utilize data validation tools to flag discrepancies and correct inaccuracies before they become roadblocks.

Conclusion A successful advisor transition hinges on accurate client data. Without it, paperwork becomes a major challenge, slowing down the transition process and negatively impacting both the advisor and their clients. By prioritizing data accuracy early, advisors can streamline the transition, enhance the client experience, and ensure compliance every step of the way. Investing time in data management before a move is not just a best practice—it’s a necessity for long-term success.

To learn how Forms Logic supports Advisor Transitions, contact our team!