The Hidden Cost of NIGOs and How to Fix Them

The Hidden Cost of NIGOs and How to Fix Them

In the financial services industry, efficiency and accuracy aren’t just operational preferences—they’re essential for compliance, profitability, and client satisfaction. Yet, one silent saboteur continues to plague broker-dealers, registered investment advisors (RIAs), and financial advisors alike: NIGOs—or Not in Good Order business submissions (new business and maintenance).

If your firm is still struggling with frequent NIGOs, you’re not alone—but you are paying for it. In this post, we’ll explore the true cost of NIGOs, why they persist, and how digital solutions like Forms Logic’s Navigator platform can help you eliminate them for good.

What Are NIGOs?

A NIGO, or "Not in Good Order" document, refers to any form or piece of paperwork that is submitted with errors, omissions, or missing information that makes it unusable or non-compliant. These can include:

- Missing client signatures

- Incomplete fields

- Mismatched data across forms

- Outdated disclosures

- Illegible handwriting (yes, paper forms are still in use!)

Each time a form is rejected due to a NIGO error, the firm must re-engage the client, correct the issue, and reprocess the form—creating delays, operational friction, and reputational damage.

The True Cost of NIGOs

The impact of NIGOs goes well beyond minor inconveniences. Here's what they're really costing your firm:

-

Financial Loss:

Every NIGO costs time and money. Reprocessing forms, chasing down signatures, and resubmitting documents consumes advisor and staff time that could be better spent on revenue-generating activities.

Industry estimates suggest that firms can lose hundreds of dollars per NIGO, especially when it results in delayed account openings or missed investment opportunities. -

Delayed Onboarding and Revenue:

Each day a client’s paperwork sits in limbo due to a NIGO, your firm is potentially losing money. Whether it’s a new account or a product switch, NIGOs delay asset transfers, commission payments, and the advisor’s ability to serve the client.

-

Advisor Frustration and Attrition:

Nothing is more frustrating to a financial advisor than losing face with a client due to back-office errors. When NIGOs become habitual, they can erode advisor trust and loyalty—leading to higher attrition and more expensive recruiting cycles.

-

Compliance Risk:

NIGOs aren’t just an operational problem—they’re also a compliance red flag. Forms submitted with errors or incomplete disclosures can lead to audit issues, regulatory scrutiny, or worse: fines.

Why NIGOs Happen

If your firm is dealing with frequent NIGOs, it’s worth understanding where the problem originates. Common root causes include:

-

Manual Data Entry:

Re-entering the same client information across multiple systems or forms increases the chance of error.

-

Lack of Standardization:

Inconsistent forms and processes across product lines or custodians lead to confusion and mistakes.

-

Legacy Systems:

Paper-based workflows and fragmented technology stacks can't keep up with modern compliance and client expectations.

-

Insufficient Checks:

Without built-in logic, advisors can easily miss required fields or submit outdated documents.

How to Fix NIGOs

The best way to reduce and eventually eliminate NIGOs is by adopting a digital processing platform with built-in compliance logic and automation. Enter: Navigator from Forms Logic.

Navigator is a cloud-based, end-to-end workflow automation solution built specifically for broker-dealers and RIAs. Here's how it helps fix the NIGO problem:

-

Single Data Entry:

Advisor inputs client data once, and Navigator intelligently maps it across all required forms—whether it's brokerage, annuities, alternatives, or insurance.

-

Built-In Form Logic

The platform includes real-time form validation, ensuring required fields are completed before submission. Say goodbye to missing signatures or incomplete checkboxes.

-

E-Signature Integration

Navigator supports compliant e-signature platforms, so clients can sign documents quickly and securely, without printing or scanning.

-

Automated Workflows

With pre-defined steps for each line of business, Navigator ensures that nothing is skipped and everything is submitted in the right order, to the right party.

-

Audit-Ready Compliance

Every document processed through Navigator is stored securely with an audit trail—making compliance checks faster, easier, and more reliable.

Why Firms Choose Forms Logic

At Forms Logic, we’ve helped firms transition from paper-heavy processes to streamlined digital workflows—reducing NIGO rates by over 70 percent in many cases.

Whether you're onboarding new clients or helping advisors transition books of business, our solutions—Navigator and Migrator—offer:

- Fast implementation (90 days or less)

- End-to-end processing for all lines of business

- Custom workflows to match firm-specific compliance needs

- Real-time support and advisor visibility

With no implementation fees and a performance-based pricing model, we make it easy for firms of all sizes to eliminate NIGOs and embrace digital transformation.

Final Thoughts

NIGOs may seem like a small nuisance, but their cumulative effect can drag down your entire business—costing money, compliance credibility, and advisor trust.

But they don’t have to.

With the right platform in place, your firm can move from reactive error correction to proactive process automation. Navigator makes that possible—allowing your advisors to focus on what really matters: serving clients and growing the business.

Ready to eliminate NIGOs for good?

Schedule a demo to see how Forms Logic can help your firm digitize workflows, reduce errors, and drive efficiency from day one.

Thurston Springer’s Digital Transformation with Navigator

We’re proud to share that Thurston Springer Financial, a respected wealth management firm, recently featured Forms Logic in an AdvisorHub article, highlighting their use of our Navigator platform to modernize and streamline their advisor operations.

As a valued client, Thurston Springer recognized the importance of equipping their financial professionals with tools that cut through paperwork and improve efficiency. Their public recognition underscores how critical the right technology is for firms looking to stay competitive.

Why Navigator?

Navigator is a powerful automation and workflow platform built specifically for financial services. Designed to eliminate manual data entry and reduce compliance risk, Navigator offers:

- Automated Workflows: Reduce manual data entry and enhance accuracy.

- Seamless Integrations: Connect effortlessly with existing systems and data sources.

- Enhanced Compliance: Ensure adherence to industry regulations with built-in checks.

- Scalability: Adapt to the growing needs of financial firms without increasing overhead.

The Bigger Picture: A Shift Toward Efficiency

In a heavily regulated and document-driven industry, advisory firms are increasingly investing in tools that automate the back office—freeing up time for what matters most: building client relationships. The article on AdvisorHub underscores this trend and illustrates how firms like Thurston Springer are proactively adapting.

See the Full Story

To learn more about how Thurston Springer is using Navigator to advance their digital transformation goals, check out the article here:

AdvisorHub: Thurston Springer Launches Forms Logic to Accelerate Digital Transformation

Bridge6: Taking the Chaos Out of Advisor Transitions

Advisor transitions are high-stakes. Whether you’re an advisor moving your book or a firm welcoming new talent, there’s a lot on the line: client trust, regulatory compliance, and uninterrupted revenue. But many transitions are messy—slowed by inconsistent processes, scattered data, and hours of repetitive paperwork. That’s exactly what Bridge6, the transition framework from Forms Logic, was built to fix.

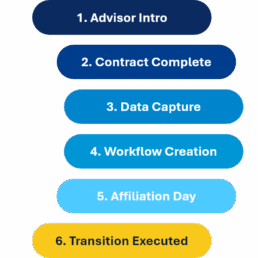

Bridge6 brings structure to what is often a disorganized process. Instead of starting from scratch with every move, advisors and firms follow a clear six-step path designed to reduce errors, accelerate onboarding, and keep clients at the center of the experience. It starts with planning and ends with execution—but in between, it’s all about gathering the right data, automating workflows, and delivering a smooth, compliant transition.

Here’s how the Bridge6 process works:

-

- Advisor Introduction – Plan the move and align on timelines, account types, and communication strategy. Leverage a detailed checklist to gather all information.

- Contract complete – Formalize the agreement and confirm data-sharing compliance.

- Data Capture – Gather, organize, and standardize client data from all sources.

- Workflow Creation – Build automated processes that generate a form bundle to prepare for pending client signature.

- Affiliation Day – Go live and begin the signing and onboarding process.

- Transition Executed – Complete account transitions and track every step through a live dashboard.

- Advisor Introduction – Plan the move and align on timelines, account types, and communication strategy. Leverage a detailed checklist to gather all information.

This method doesn’t just look good on paper—it delivers real results. As shared in our webinar and eBook, firms using Bridge6 through the Forms Logic platform have cut transition timelines by nearly half, potentially saving tens of thousands or more in revenue loss depending on your total AUM. More importantly, advisors feel supported instead of overwhelmed—and clients stay confident throughout the process.

Ready to Learn More?

Seamless Transitions: The Advisors Guide to Moving with Confidence

Onboarding Advisors without the Chaos

Migrator: The Best Advisor Transition Software for RIAs and Broker-Dealers

RIA and Broker-Dealer transitions can be complex and time-consuming. Forms Logic’s Migrator software streamlines the advisor transition process, automating compliance paperwork and reducing delays for financial professionals. Here’s why clients choose Migrator to streamline their transitions:

- Comprehensive Logic for All Firms, Vendors, and Custodians FL works to ensure there is a complete library of logically coded forms for every major firm, vendor, and custodian in the industry. This ensures you have the exact documentation needed for account openings and transitions without the hassle of manual research and form preparation.

- Proprietary Upload Spreadsheet for Data Normalization Our proprietary upload spreadsheet allows users to normalize all client account data. This step ensures a clean, organized data set that can be seamlessly loaded into the Migrator system. No more worrying about data inconsistencies or mismatched formats.

- Intelligent Form Selection and Auto-Population Once your data is uploaded, Migrator’s advanced logic determines the specific forms required for each account opening. It then auto-populates these forms with the relevant data from your spreadsheet, saving hours of manual input and reducing the potential for errors.

- Flexible Sign Options and Back-Office Integration Migrator offers both print and e-signature options for completed forms. Regardless of the signing method chosen, the system ensures that completed forms are routed directly to the back office for swift processing. This end-to-end workflow eliminates unnecessary delays and keeps your transition on track.

- Fast Implementation and Transition Timelines

- New Firm Setup: Migrator can onboard a new firm in just 2-4 weeks, depending on the quality of the forms provided.

- Transition Timelines: Once the site is set up, each advisor transition can be completed in as little as two weeks, with a typical estimate of four weeks depending on the availability and quality of data.

Why It Matters Migrator reduces the stress and complexity of advisor transitions by leveraging intelligent technology and streamlined workflows. With faster transitions, fewer errors, and comprehensive support, Migrator empowers firms to maintain business continuity while scaling their operations.

Ready to transform your transition process? Migrator is here to make it happen.

The Key to a Smooth Advisor Transition: Accurate Client Data

Transitioning to a new firm is a pivotal moment for any financial advisor. While many factors contribute to a successful transition, one element stands out as crucial—accurate client data. Without it, completing paperwork, onboarding clients, and ensuring a seamless transition become significantly more difficult. In this blog, we’ll explore why accurate client data is essential and how it impacts every step of the transition process.

The Role of Accurate Client Data in Transitions Every advisor transition involves paperwork, from account opening forms to transfer authorizations and compliance documentation. Having incomplete or inaccurate client data can lead to delays, errors, and frustrated clients (and you as the advisor!). Here’s why precise data is critical:

- Efficient Paperwork Completion

Most transitions require a substantial amount of documentation. Missing or outdated client details, such as incorrect Social Security numbers, outdated addresses, expired driver's licenses, or missing account numbers, can cause unnecessary delays and rework. - Faster Client Onboarding

Accurate data ensures a smoother onboarding experience, reducing back-and-forth communication with clients and custodians. Advisors who enter transitions with well-organized client records can expedite the process and avoid bottlenecks. - Regulatory and Compliance Accuracy

Compliance requirements demand precise documentation. Errors in client data could trigger compliance issues, requiring additional verification and delaying account transitions. - Enhanced Client Experience

Clients expect a seamless transition. When their accounts are moved efficiently without administrative headaches, it reinforces trust in the advisor’s ability to manage their wealth effectively.

How to Ensure Data Accuracy Before a Transition To mitigate potential challenges, advisors should take a proactive approach to data management before initiating a transition:

- Conduct a Data Audit – Review client records and verify key details such as contact information, account numbers, and beneficiary designations.

- Use CRM Systems Effectively – Ensure that all client information is up-to-date in your CRM and synced with custodians and back-office systems.

- Standardize Data Entry Practices – Implement consistent data entry protocols to prevent errors and inconsistencies.

- Leverage Technology for Validation – Utilize data validation tools to flag discrepancies and correct inaccuracies before they become roadblocks.

Conclusion A successful advisor transition hinges on accurate client data. Without it, paperwork becomes a major challenge, slowing down the transition process and negatively impacting both the advisor and their clients. By prioritizing data accuracy early, advisors can streamline the transition, enhance the client experience, and ensure compliance every step of the way. Investing time in data management before a move is not just a best practice—it’s a necessity for long-term success.

To learn how Forms Logic supports Advisor Transitions, contact our team!

Client Input: The Powerful Weapon that Makes Advisors Effective

One nightmare scenario for Broker-Dealers is a transaction that gets delayed because of paperwork. But it’s all too real a scenario when advisors or back-office staff have to manually input client information. Far better, of course, is to already have the client information in the system so you can use it to pre-populate your forms. But what if some of that client information is incorrect or outdated?

When the founders of Forms Logic designed Navigator, they had seen this enough times to know it had to be addressed. And the key was the method and process for gathering that client input. It’s not enough to simply ask a client to provide their information. The process must be thorough and filled with quality-control measures.

How it Starts

It starts by making it easy for anyone involved in the process – whether that’s the advisor, a back-office staffer or someone else – and then starting the application where a client creates their profile. Once the data is ready to be deployed via pre-populated forms, the customer verifies everything. This is critical because information does change. A client might move between the time the profile is created and the time a transaction is made.

The client verification step sets you up for a smooth automated paperwork process with few, if any, (not in good order) NIGO issues.

By the way, even if the client updates their information when the advisor is in the middle of a transaction, Navigator updates the information behind the scenes so the most up-to-date information will be deployed and mapped on the form.

This process helps to create company libraries that will ensure the most accurate, complete, and timely information for every transaction.

Client input is critical. It doesn’t have to be difficult or overly demanding for the client. But it does have to be done right, which is why the Navigator process was designed to ensure that is exactly what will happen. Every time.

Eliminate Advisor Frustration

We’ve seen it happen too many times. An advisor has a transaction to process, and time is of the essence. They pull together all the required forms (or so they think) and set about completing them with the client – a time-consuming and tedious task that’s a part of the routine process.

Then something goes wrong. . .the dreaded NIGO! The Broker/Dealer back office rejects and returns the paperwork as “Not in Good Order” due to something as simple as a name recorded with the wrong spelling or another important field that has been populated incorrectly.

Unfortunately, no one caught these easily corrected errors until after the paperwork had been submitted. And even if they were identified prior to submission, the advisor still has to redo all the paperwork with the client. That’s not a great confidence builder for the client, and it can even make them question the competency of their advisor.

When advisors have dealt with these types of embarrassing, time-wasting, and costly image-shattering moments enough, they start to view paperwork like a march to the gulag. Don’t let that advisor’s frustration with paperwork negatively impact your business relationship with them. If you ignore the pain that NIGO paperwork causes for the advisor, they will eventually look for a new Broker/Dealer that can help them solve their problem.

Forms Logic has worked hard to ensure advisors won’t experience the pain of NIGOs ever again.

We don’t just automate the process of filling out the forms. We also store the data and can apply it to thousands of different forms. We’ve made it possible to use “smart form-filling,” a process that knows what information to put in each spot and guides you through the process so you can easily understand the step-by-step sequence that gets everything completed and all the correct fields e-signed.

It’s hard enough work for advisors to find and service clients and obtain new business – that’s where the Broker/Dealer can shine. Advisors shouldn’t have to experience panic attacks over which form to use, which e-sign vendor to select, or whether all the data was populated on the correct lines. It can and should all be automated and done electronically.

We are experts. Our Navigator platform has already done your thinking and hard work. We refuse to let another advisor experience frustration over processing their paperwork.

Let us help. You’ll be glad you did.

How Do You Select the Right e-Sign Provider?

DocuSign is like Kleenex or Xerox in the e-sign world. It’s such a dominant brand that it sometimes gets confused with the entire industry. (Ever offer someone a Kleenex and then hand them a Puffs? Grandpa Puffs hates when you do that but this is the power of branding.) But DocuSign is far from the only e-sign vendor in the field, and for many companies it’s not the one that makes the most sense for them to be using.

DocuSign is a very robust technology, and you’ll never go wrong using it. But DocuSign also bills you large amounts in advance, regardless of how (or how little) you use it. For companies whose e-sign needs don’t match that type of billing arrangement, it makes sense to look for another option. But how do you choose?

This is where the good news comes in: If you work with us at Forms Logic, you don’t have to choose. We consolidate e-signature services into one platform. We have relationships with all types of vendors and we can tell you exactly which one makes the most sense for you based on your usage.

But it’s more than that.

We also serve as the integration platform, so all you have to do is send the data to us and we take it from there. We send the paperwork to the various e-sign vendors and they handle the rest. It couldn’t be simpler for you.

Not only that, but because we deal with so many vendors in such high volumes, we have tremendous buying power. That allows us to negotiate much more favorable rates on your behalf. Not every vendor is a good fit for every industry.

Some vendors aren’t set up to meet the needs of financial services companies. Some provide unlimited signatures while others don’t.

You could spend a lot of time trying to investigate all of these vendors and measure them against your specific needs. But if you simply work with us, we’ll save you the trouble of the research (because we already know), and we’ll save you money with our buying power.

And of course, we simplify the process. We create all the documents to be signed. We handle distribution and all the other details behind the scenes. Just signing the documents isn’t the hard part, of course. It’s gathering the data, putting it all where it belongs and making sure it works correctly.

When we can make it that simple, it’s an easy choice to go with us. That’s why so many firms do.

Navigating Advisor Transitions: The Top 3 Challenges & Solution Facing Broker-Dealers

The advisor recruitment market is staying hot this year on the heels of an active year in 2022, according to the most recent Diamond Consultants Advisor Transition Report. However, as a Broker-Dealer, managing advisor transitions is no easy feat. There’s no shortage of challenges that can arise during an advisor transition.

In this blog, we’ll explore the:

Challenges facing independent broker-dealers as they navigate advisor recruiting.

Solution firms can apply to differentiate themselves from the crowded marketplace.

Challenge #1: Regulatory Compliance Hurdles

The financial services industry is heavily regulated, and the advisor recruitment arena is no exception. Transitioning and onboarding new advisors must adhere to strict regulatory and compliance requirements set forth by FINRA, the SEC, individual states, and other regulatory bodies.

While each Broker-Dealer should look to their compliance teams for legal guidance around managing advisor transitions, there are a few key regulations to be aware of considering lack of adherence could result in legal and financial consequences:

- Advisor Registration & Licensing: Confirm that the advisor you are looking to transition has properly registered with the SEC or FINRA. Their licenses should be fully updated to reflect how they work with clients. The transitioning advisor should also be compliant with AML regulations as discovered through appropriate due diligence.

- Broker Protocol: Originally formed in 2004 as an agreement between large Broker-Dealers about how to handle advisors moving firms, Broker Protocol dictates standard procedures firms should follow in an advisor transition. The procedures outline what client information can go with an advisor when they transition firms, and how the transitioning advisor should handle their resignation. Advisors wishing to follow Broker Protocol must follow procedures to the letter, so it’s important to become intimately familiar with its requirements.

- Review Non-Solicitation Agreements & Transition Disclosures: Confirm the transitioning advisor doesn’t have a non-solicitation from a prior firm that could impact your work with them. It’s also worth checking to see the advisor’s disclosures to see if there are any conflicts of interest before the transition process kicks off.

Navigating these complex compliance procedures during transitions is no cake walk, but data and proper documentation add a new layer of risk that can’t be ignored.

Challenge #2: Documentation, Data & Risk Mitigation

Broker-Dealers commonly experience challenges organizing and transferring client information, account data, and historical records accurately–and in a compliant manner.

Advisor transitions involve shuffling vast amounts of data and documentation. That makes ensuring the security and integrity of sensitive client information throughout the transition a top priority. And it should be. Maintaining compliant client communication not only creates a seamless client experience during the transition phase, it helps the transitioning advisor maintain client relationships and trust—which could earn you more referrals.

One of the best ways to maintain a high quality of service during the transition process is to leverage a technology that makes managing high-volume paperwork and data seamless.

Challenge #3: Resource Allocation and High Costs

From compliance, to data security, client communication, and everything in between, it’s no surprise that advisor transitions are an all-hands-on-board effort. Broker-Dealers competing for advisory talent today need to find the best balance between their available resources and costs.

Time-consuming processes leading to delays in onboarding new advisors also make it difficult to allocate resources effectively. Delays tend to cause bottlenecks and inefficiencies that make swift transitions more difficult. Balancing the financial impact of advisor transitions with the firm’s resources is not always an easy challenge to solve.

But, technology designed to support secure advisor transitions without requiring more of your firms’ resources can make solving this challenge simple.

Meet the Compliance-Friendly, Seamlessly Secure Advisor Transition Experience

Forms Logic has pioneered a one-of-a-kind cloud-based technology that transforms the paperwork experience. With Forms Logic, firms have the ability to:

Save and retrieve tens of thousands of forms

Remember information

Apply even the rawest data in minutes

These benefits simplify a process that used to take hours while making it more thorough and accurate than ever.

Forms Logic offers an innovative solution called the Forms Logic Migrator Platform, designed specifically to support advisor transitions to your firm. Through pre-populating advisor paperwork, the automated workflows set up in Forms Logic Migrator Platform saves Broker-Dealers time, costs and effort during the transition process.

If you want to learn more about implementing Forms Logic Advisor Migrator platform to reduce NIGOs and make your transition process seamless, get in touch with us today to discuss your requirements.

Taking Care of a Traumatized Broker-Dealer

One of the worst things we see in the financial services industry is failed technology implementations and deployments. Many Broker-Dealers on a quest to deliver better service to their advisors – while at the same time endeavoring to reduce their processing costs – have been left traumatized by the fintech providers they entrusted with their firm’s modernization.

We’re talking, of course, about the type of back-office support technology that automates and streamlines much of your operation – especially when it pertains to documents and paperwork. This is a crucial issue for Broker-Dealers. Paperwork must be accurate but you can’t afford to have it become a time-sucking administrative nightmare at the cost of valuable production.

So, you can’t help but listen when heavily promoted companies come along and offer digital platforms that are supposed to solve all these problems for you. These companies couldn’t have grown as rapidly as they have without delivering on their promises, you figure. They appear to have the technology. They also appear to have the people with the required expertise. How can their product not solve your problems?

But before long, you learn the unpleasant answer to that question: It can’t solve your problems if they can’t implement it. And far too often, that’s the case. We hear lots of discouraging stories about Broker-Dealers that were promised a quick implementation only to find themselves bogged down in a protracted one that hasn’t gone as advertised. To add insult to injury, they are saddled with paying additional fees for the lengthy implementation. Is it because the technology they purchased is flawed? Is it because the solution provider doesn’t know how to work with your team and help them resolve pain points?

Now you’re left with a significant financial investment in technology that’s delivering no value because your organization isn’t empowered to use it. Or if you were fortunate enough to survive the implementation phase relatively intact, you are now faced with deploying technology to your advisors that has thus far underwhelmed your back office.

The decision to go with the heavily promoted name is understandable. You expect results from established companies. But what you learned from this experience is that you should be leery about writing a big check to a technology solution provider that hasn’t proven their technology works.

And that’s why so many Broker-Dealers are turning to Forms Logic. Rick Burgess, CEO and Founder, and his team complete implementations of the Navigator business processing platform in a matter of weeks. The longest implementation the company has ever had, under very challenging circumstances, was three months – and that customer, like all Forms Logic customers, wasn’t asked to pay a dime until the system was operational.

Yes, you read that correctly. . . you won’t be asked to pay for the implementation or licensing fees until the Navigator platform is operational.

Moreover, Forms Logic sees implementations as a means to an end, not a profit center like other firms, so its fees are very reasonable and affordable.

Forms Logic knows how to support teams through the on-boarding process, and its team works tirelessly to make sure you are getting the full value out of Navigator. The team members know how to configure the Navigator platform to fulfill each client’s business needs. They do considerable work at the front end and they understand how to approach things. Plus, they stay involved as you’re ramping up to make sure you’ve got things rolling as they should.

Better known companies aren’t always the better choice. The best solution is a robust technology that you can actually use, and one that won’t waste months of your time in the implementation phase with huge cost overruns.

Broker-Dealers don’t need to suffer under this kind of stress only to end up thoroughly disappointed because they placed their trust in the wrong technology solution provider.

That will never happen with Forms Logic. This is what they do.