MAKE EVERY MOVE SEAMLESS WITH

Migrator

Trusted by hundreds of advisors, Migrator by Forms Logic delivers an efficient, personalized, end-to-end transition solution — from compliance and data security to client retention.

The Forms Logic Migrator Advantage

Migrator delivers seamless, compliant transitions through a proven, end-to-end process. With tailored support, regulatory expertise, and a focus on client retention, we make every move smoother, faster, and more secure.

Expert Guidance

We work closely with each firm to understand their specific account opening and transfer requirements, ensuring every legal and regulatory step is handled with precision.

Time Efficiency

Migrator is built to save you time by managing the entire transition process, so you and your team can stay focused on serving your clients.

Data Security

Our platform is designed with security at its core, protecting sensitive financial data throughout every step of the transition.

Client Retention

By making transitions secure and stress-free, we help advisors maintain client trust and loyalty through every stage of the move.

Seamless Transition

“Forms Logic was extremely helpful in providing my office with the proper training, support, and follow up that was key to the transition of data that my office had successfully completed. My office staff and myself appreciated the seamless transition."

Paul Logan | PresidentLogan Insurance & Financial Services, LLC

TRANSITION CASE STUDY

How a Financial Advisor Quickly Automated Transitions with Forms Logic

Ready to streamline your transition process? Download our case study to see how Carlos Benedeti transformed his firm move with Forms Logic, reducing paperwork and accelerating success in just 45 days. Discover key strategies to optimize your workflow and make your transition seamless.

Transition Challenges?

Why Advisor Transitions Are So Challenging

Before you choose a transition solution, it’s important to understand what’s at stake.

Advisor transitions aren’t just about moving accounts — they’re about protecting relationships, maintaining trust, and ensuring nothing falls through the cracks. Without the right tools and strategy, transitions can be messy, stressful, and costly.

Tech Challenges

Without the right technology, transitions slow down, errors creep in, and revenue can be lost.

Asset Transfers Are a Minefield

Missing or mishandled assets can damage portfolios and relationships — and even cause clients to walk away.

Potential for Mistakes

Errors in client data can create big problems and slow the entire transition process.

Brand and Reputation

A mismanaged transition can harm your professional image and client confidence.

Time Consuming

Transitions pull focus from clients and daily business — costing valuable time.

Compliance Issues

Every move must align with strict regulations. Sloppy paperwork isn’t an option.

Why Are Advisor Transitions So Challenging?

Before you choose a transition solution, it’s important to understand what’s at stake.

Advisor transitions aren’t just about moving accounts — they’re about protecting relationships, maintaining trust, and ensuring nothing falls through the cracks. Without the right tools and strategy, transitions can be messy, stressful, and costly.

Time Consumption

Transitions pull focus from clients and daily business — costing valuable time.

Asset Transfers Are a Minefield

Missing or mishandled assets can damage portfolios and relationships — and even cause clients to walk away.

Potential for Mistakes

Even small errors in client data can create big problems and slow the entire transition process.

Brand and Reputation

A mismanaged transition can harm your professional image and client confidence.

Tech Challenges

Without the right technology, transitions slow down, errors creep in, and revenue can be lost.

Compliance Issues

Every move must align with strict regulations. Sloppy paperwork isn’t an option.

THE FORMS LOGIC SOLUTION

How Migrator Works

STEP 1

Advisor Introduction

During this initial step, Forms Logic works with the advisor to define the scope of the transition — including account types, custodians, and timelines. Together, we identify key variables such as affiliation dates, technology needs, and client communication strategies. This foundation ensures the process moves forward with clarity, speed, and minimal disruption.

This Step Includes:

- Kick-off Call

- Info Gathering

- Coaching & Advising

STEP 2

Contract Complete

To move forward, a formal Service Agreement is established between Forms Logic and the advisor. Compliance with Regulation S-P laws is confirmed, and the responsibilities of both parties and confirms any payment terms related to the transition process are set.

Key Contract Features Include:

- Confirmation of Data Ownership

- Confirmation of Client Consent

- Outlining of Payments

STEP 3

Data Capture

With the right data, transitions move faster, cleaner, and with fewer errors. In this step, Forms Logic helps advisors gather, standardize, and securely share client data. We also account for signing preferences, enabling each account to be processed via e-sign or wet-sign as needed.

Our Process Includes:

- Secure Data Transfer

- Normalization & Mapping

- Signing Method Flexibility

- Hands-On Support

STEP 4

Workflow Creation

Once the advisor's data is reviewed and approved, Forms Logic builds automated account workflows tailored to each client. These workflows streamline the transition process by bundling required forms, applying back-office routing rules, and embedding key audit controls. Advisors and staff are trained to navigate the platform, review form bundles, and ensure everything is ready for back-office submission.

Key Features Include:

- Automated workflow generation

- Built-in compliance

- Role-based access

- A streamlined review process

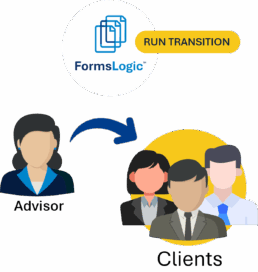

STEP 5

Affiliation Day

This is the official launch of the transition. On affiliation day, the Forms Logic system is unlocked, giving advisors access to begin the signing process. All pre-built workflows, documents, and data are now live and ready to be processed. With everything in place, onboarding can begin — for the advisor and their clients — efficiently, securely, and at scale.

What Happens on Affiliation Day:

- System access is activated

- Workflows and documents are unlocked

- Transition moves into action

- Full readiness across systems

STEP 6

Transition Executed

With affiliation complete, the final step is executing the transition. Completed transactions flow directly to the back office for processing. eSigned items are automatically routed through the system, while wet-signed documents are scanned and uploaded. The platform also communicates updates and corrections in real time, and a dashboard provides advisors the status of all transactions.

Final Processing Includes:

- Completed transactions are routed to the back office

- Flexible handling of signatures

- Built-in tracking and updates

- Real-time dashboard visibility

Watch the Explanation:

During our Migrator Webinar, our COO Joel Friedman outlined Forms Logic’s Bridge6 advisor transition process.